Key Takeaways:

- Your investment time horizon should directly determine risk level, asset choice, and portfolio structure.

- Investments that suit long-term goals can become risky as your target date approaches.

- Reducing risk over time helps protect gains when you no longer have time to recover losses.

- Portfolio adjustments are about aligning risk with goals, not predicting market movements.

- Ignoring time horizon changes can jeopardize major life goals like retirement or buying a home.

- Regular portfolio reviews ensure your strategy evolves as goals, timelines, and circumstances change.

Understanding Your Time Horizon

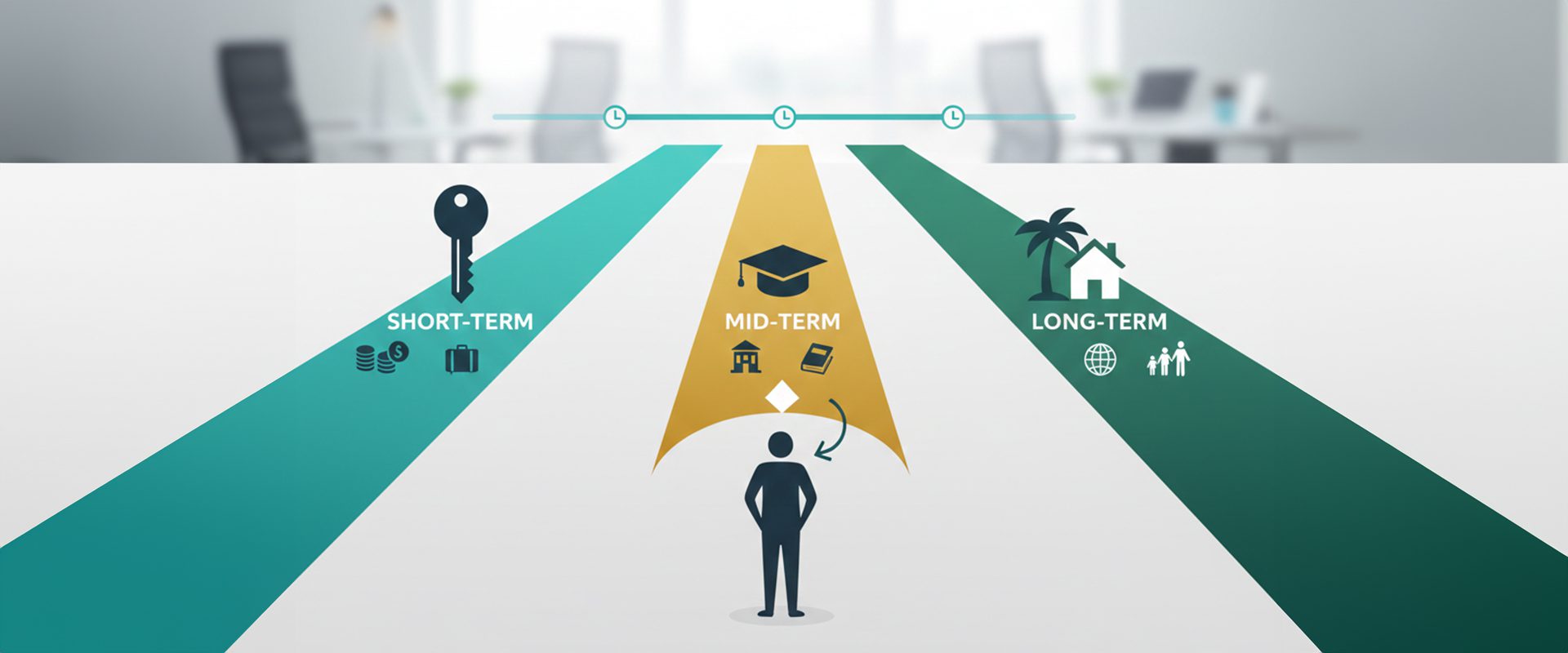

Understanding your time horizon is one of the most important steps in building a resilient and goal-focused investment strategy. Whether you are saving for retirement, a home, or long-term wealth creation, the length of time you expect to stay invested should directly influence your choices, your risk tolerance, and how you respond to change.

Recap: Understanding Time Horizon

In part 1 of this article, we discussed what a time horizon is and how it should affect the selection of your investments. As a quick recap, the time horizon is the length of time an investor expects to own their investment and can be determined by estimating the length of time it will take to reach a particular financial goal.

The less time you have until you will need the invested money, is the more conservatively you should invest, since you are unlikely to have enough time to recoup any losses if they occur.

In this continuation, we will be discussing the need to change your investment strategy as your time horizon reduces.

Why Holding the Same Investment Can Be Risky

Quite often, investors put their money into an aggressive investment, such as growth stocks, and then keep it there indefinitely. This is not a smart move. An investment may be a good choice for you at the time it was purchased, but it can become less and less appropriate as time passes and your time horizon reduces.

An aggressive investment strategy can work well when you have decades ahead of you. However, as the end date approaches, exposure to volatility increases the risk of a sudden loss that cannot be recovered in time.

Adjusting Your Investment Horizon as Goals Approach

As your target date draws closer, preservation becomes just as important as growth. This is where proactive portfolio adjustments matter.

As the date you will need the funds approaches, it is prudent to adjust your portfolio. Assets should be shifted to more conservative investments to reduce the risk of market-related losses derailing your strategy. For example, as you near retirement age, you should shift your portfolio from equities to the relative stability of high-quality bonds.

This process is not about timing the market but about aligning risk with reality.

Common Adjustments as Time Horizon Shortens

- Reducing exposure to volatile assets

- Increasing allocation to income-producing investments

- Improving liquidity for near-term access

- Protecting capital against a sudden market shift

A financial advisor from Sterling can help determine the pace and structure of these changes.

Real-World Examples of Time Horizon Risk

The impact of ignoring your time horizon becomes clear when viewed through real scenarios.

Imagine if you started investing for your retirement in your twenties. At that age, you would likely have been advised to invest in stocks given your long-time horizon. For years, a bull market reigns, and the balance grows, and so you make no adjustments to your portfolio. Then, just as you are about to retire, a decline in the stock market wipes out a substantial portion of your nest egg!

This situation highlights why an investment approach must evolve, even during favorable market conditions.

Read more on Investing for Your Retirement.

Buying a Home and Short-Term Goals

Another example would be if you had been investing for 6 years to purchase a home and now have the required amount for a deposit. At the point when you have started actively looking to make a purchase, it would be best to move your invested funds into a short-term fixed-rate investment that you can access (liquidate) on short notice.

A fixed-rate investment can help protect your savings from last minute volatility while ensuring funds remain accessible.

This will ensure that you can act quickly. The housing market is currently very competitive, and you do not want to miss out on your dream home because you cannot access your invested funds or because a last-minute market shift significantly reduces the invested sum, and you are no longer able to afford it. That would be heartbreaking.

Review and Rebalance Regularly

To avoid this fate, you should adjust your investment portfolio as your time horizon changes. No matter what your time horizon is, you should have a discussion with your financial advisor about what investment approach may be appropriate for your particular situation. Regular reviews help ensure that your strategy remains relevant, responsive, and resilient.

Ready to align your investments with your time horizon? Connect with a Sterling Financial Advisor and take the next step with confidence.

FAQs

How does liquidity influence investment choices?

Liquidity determines how quickly investments can be converted to cash without loss of value. When funds may be needed on short notice, higher liquidity becomes increasingly important.

What happens if market conditions change suddenly?

A sudden market shift can affect short term investment values. This is why aligning investments with your timeframe and adjusting them as goals approach can help limit unexpected setbacks.

Can having multiple goals affect investment decisions?

Yes. Investors often have more than one goal, each with a different timeline. In these cases, it may be appropriate to structure separate portions of the portfolio to reflect different timeframes and risk levels.

How often should an investor review their investment time horizon?

Your time horizon should be reviewed whenever there is a significant life change, such as a new financial goal, a career shift or approaching a planned withdrawal date. Even without major changes, an annual review helps ensure your strategy remains aligned.

From The Sterling Team

Toni-Ann Neita-Elliott, CFP is the Vice President, Sales & Marketing at Sterling Asset Management. Sterling provides financial advice and instruments in U.S. dollars and other hard currencies to the corporate, individual, and institutional investor.

Visit our website at www.sterling.com.jm

Speak with a Sterling Advisor

Feedback: If you wish to have Sterling address your investment questions in upcoming articles, e-mail us at: info@sterlingasset.net.jm