Key Takeaways:

- Your time horizon determines how much risk and volatility your investments can realistically tolerate.

- Matching investments to your time horizon helps prevent emotional decisions during market fluctuations.

- Short-term goals require stability and liquidity, not aggressive growth strategies.

- Medium-term investing benefits from diversification that balances growth with risk management.

- Long-term investors can leverage time to absorb volatility and pursue higher growth opportunities.

What Is Your Time Horizon, and Why Does It Matter?

Your time horizon refers to the length of time you expect to hold an investment before you need to access the funds. In simple terms, it answers the question: When will I need this money?

Below is the core principle every investor should understand. The following information is kept exactly as written, broken into sections and highlighted for clarity.

Defining Your Time Horizon

When deciding on what type or types of investments you should hold, there are very few questions that are more important than, “What is your time horizon?” The time horizon, or investment horizon, is the length of time an investor expects to own their investment.

If you can estimate the length of time you think it will take to reach your financial goal, then you will have an idea of what your time horizon is. This will determine the amount of risk you can take and the amount of volatility you can tolerate, therefore guiding your investment selection—what is appropriate, what to avoid, and how long to hold your investment before selling.

Understanding that your time horizon is directly linked to risk helps investors avoid emotional decisions during periods of volatility and market uncertainty. At Sterling, helping clients align their investments with clear goals is central to long-term financial success. Knowing why and when you need your money allows you to invest with confidence rather than uncertainty.

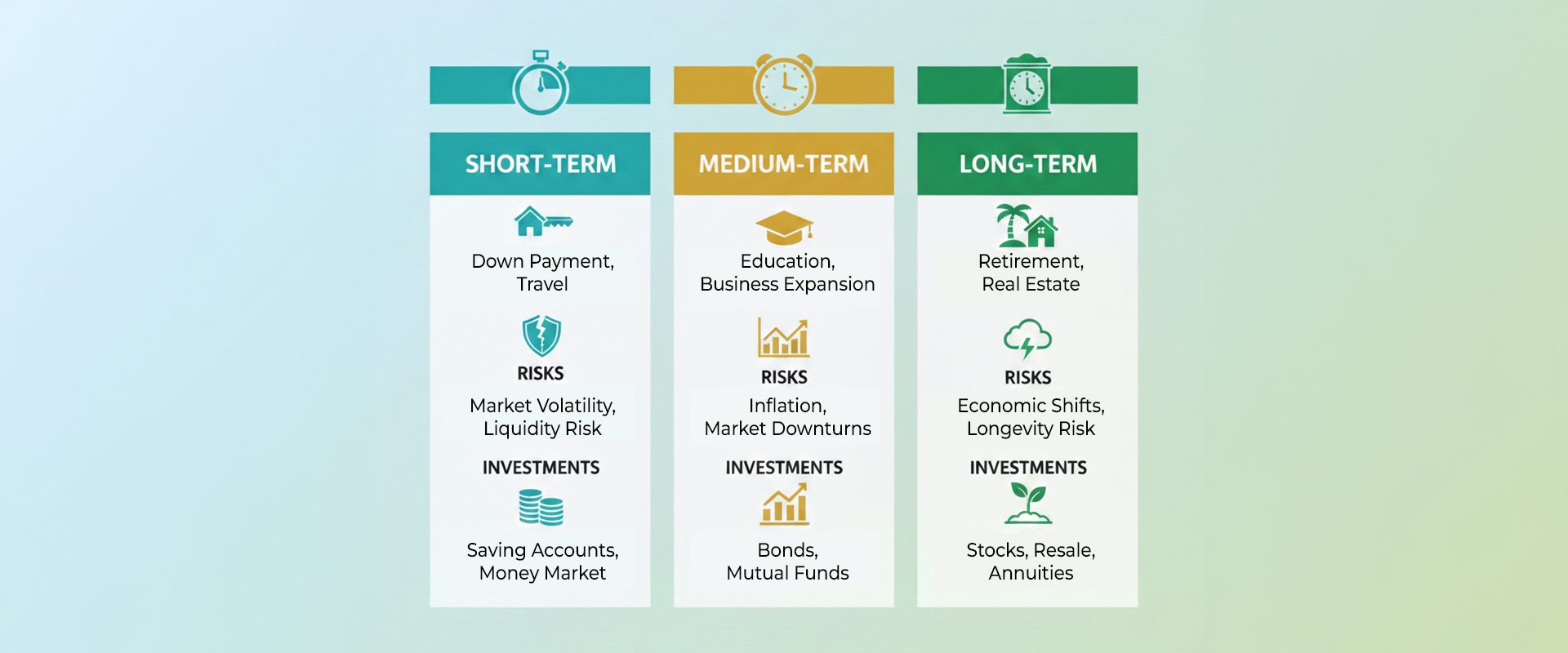

Types of Investments Based on Time Horizon

Different goals require different approaches. Below is a user-friendly overview showing how time horizon influences types of investments.

| Time Horizon | Typical Goals | Risk Level | Common Investment Types |

| Short term (under 5 years) | Car, vacation, home deposit | Low | Cash equivalents, short-term bonds |

| Medium term (5–10 years) | Education, second home | Moderate | Balanced funds, bonds |

| Long term (10+ years) | Retirement, wealth building | Higher | Stocks, growth-focused funds |

This framework helps investors balance capital preservation with growth potential.

Good Investments for Short Time Horizons

Short-Term Investing Explained

Having a short time horizon means that you will need the money you invest in the near future. As a rule, short-term goals are those less than 5 years. Examples of short term investments include saving for a car, vacation, or the down payment on a home.

If your time horizon is short, it means that you have a couple of things working against you. First, you do not have much time to make your money grow. Second, if a drop in the market occurs, the date on which the money will be needed will be too close for the portfolio to have enough time to recover the losses.

Because market downturns can occur unexpectedly, investors with short-term goals should prioritize liquidity and stability over aggressive returns.

Conservative Strategies for Short-Term Goals

As a result, it usually makes sense to invest conservatively if you have a short time horizon. Invest in lower-risk investments that are easy to turn into cash, such as repurchase agreements or promissory notes.

Other investments like short-term bonds can be a prudent move, but in general, you will want to avoid stocks. Betting on a positive stock market move in any given year is a gamble that you typically should not make with money you absolutely need and cannot afford to lose.

Investing for the Medium to Long Haul

Medium-Term Investing

Your time horizon would be defined as medium term if the goal you are investing towards is 5 to 10 years in the future, such as saving for your children’s college education or purchasing a second home.

Medium-term investors often benefit from diversification, balancing stability with modest growth.

Long-Term Investing and Growth

If you know you have many years before you will need the cash, for example, when investing for retirement, you have a long-time horizon—typically defined as more than 10 years. With time on your side, you can take more risks with the peace of mind that if you have losses, you have time to make them up. You can even take advantage of short-term market downturns to invest more at cheaper prices.

This is where growth-oriented assets become more attractive, as time allows volatility to smooth out.

Role of Mutual Funds and Higher-Risk Assets

Mutual funds that are invested in a balanced mix of bonds (and possibly a little equity exposure) are suitable for both medium- and long-term investors. However, if you have a long-time horizon, the most suitable investments are stocks and other higher-risk assets since the potential for growth becomes more important than the need for capital preservation when you have more time to play with.

The volatility that those asset classes suffer over shorter periods of time tends to smooth out and leave investors with higher total returns in the long haul.

Read more on The Types of Mutual Funds.

Why Time Horizon Should Always Come First

In conclusion, determining your time horizon is one of the crucial first steps an investor should take when creating a portfolio. It can help you plan better and improve the likelihood of investment success.

Pay keen attention to whether your advisor asks you about your time horizon or goals, as this is an indication that they know what they are doing and will help you to choose an appropriate investment.

By starting with a clear understanding of your time horizon, investors can make more informed decisions, manage expectations and build portfolios aligned with real-life goals.

Start with your time horizon and build an investment strategy that fits your goals. Speak with a Sterling advisor to understand which investments align with your timeline, risk tolerance and long-term objectives.

FAQS

Can market downturns impact short-term investors more severely?

Yes, short-term investors are more exposed to the effects of market downturns because they may not have enough time for their portfolio to recover before funds are needed.

Is it risky to invest in stocks with a short time horizon?

Stocks can be risky for short-term investors because price fluctuations may result in losses at the time funds are required. They are generally more suitable for investors with longer time horizons.

Are mutual funds appropriate for medium-term investing?

Mutual funds with a balanced mix of assets can be suitable for medium-term investors, offering diversification and moderate growth potential while managing risk.

How does a long time horizon change risk tolerance?

A longer time horizon allows investors to tolerate short-term volatility, as there is more time to recover from losses and benefit from long-term market growth.

From The Sterling Team

Toni-Ann Neita-Elliott, CFP is the Vice President, Sales & Marketing at Sterling Asset Management. Sterling provides financial advice and instruments in U.S. dollars and other hard currencies to the corporate, individual, and institutional investor.

Visit our website at www.sterling.com.jm

Speak with a Sterling Advisor

Feedback: If you wish to have Sterling address your investment questions in upcoming articles, e-mail us at: info@sterlingasset.net.jm