Key takeaways

- CoCos are hybrid bonds that can convert into equity or be written down if a bank’s capital falls too low.

- CoCo bonds sit below senior and subordinated bonds in the capital structure, which means they have higher yields but greater risk.

- Compared with high-yield junk bonds, CoCos from strong issuers may offer better credit quality and recovery prospects.

- Investors should understand features like conversion triggers, coupon suspension, and volatility before adding CoCos to their investment portfolio.

Understanding Credit Risk

Credit risk is one of the most fundamental concepts in fixed income investing. It refers to the possibility that a borrower (whether a company, financial institution, or government) will fail to make timely payments of interest or principal on its debt.

Defaults like those of Digicel and the Government of Barbados show how credit risk can affect investors. To make up for this possibility, riskier bonds pay higher yields than safe government bonds.

The difference between the yield earned and a risk-free benchmark (such as the US or German Government) is an indicator of the credit risk of a bond. This yield difference, often referred to as the credit spread, is particularly important when comparing investment-grade bonds to subordinated bonds or hybrid bonds like contingent convertible bonds (CoCos).

Capital Structure and Subordinated Debt

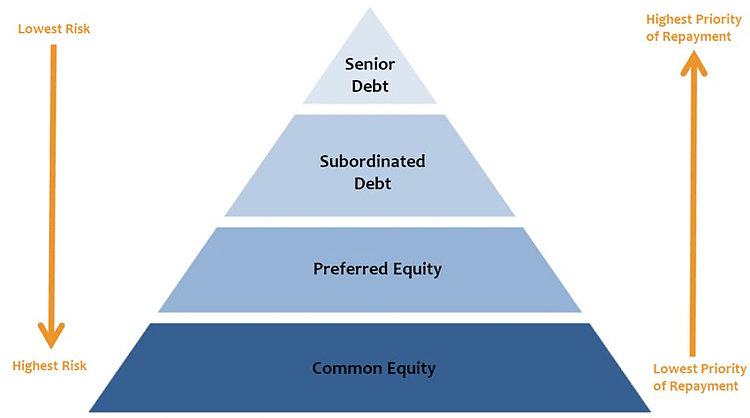

Not all bonds carry the same level of credit risk, even when issued by the same company. This is because a company’s debt is typically issued at different levels of its capital structure.

The capital structure ranks obligations in order of payment priority, from senior secured debt at the top, down to subordinated debt, hybrid instruments like contingent convertible bonds (“CoCos”), and finally to equity holders at the bottom. When a company gets into financial trouble, the most senior creditors have the first claim on assets, while junior creditors and shareholders absorb losses first.

For investors, knowing where an instrument sits in the capital structure is essential. Senior secured bonds carry the lowest risk, subordinated bonds take on more, and CoCos absorb losses even earlier than equity holders in certain cases. This makes CoCos one of the riskiest but potentially most rewarding segments of the bond market.

Enhancing Returns by Moving Down the Capital Structure

For investors seeking higher yields than senior bonds offer, one strategy is to move further down the capital structure by investing in subordinated debt or hybrid bonds.

Subordinated bonds rank below senior debt but above equity, meaning they are more exposed to losses if the issuer fails. To compensate investors for this increased credit risk, subordinated bonds offer higher yields.

This balance of taking on more credit and structural risk in exchange for higher income sits at the heart of fixed-income investing. Each investor must decide whether the extra yield from subordinated and hybrid bonds, such as contingent convertible (CoCo) bonds, justifies the risk.

What Are Contingent Convertible Bonds (CoCos)?

Contingent convertibles, or CoCos, are hybrid securities that automatically convert into equity or are written down if the bank’s capital falls below a predefined threshold. These triggers are often linked to regulatory capital requirements, such as the Common Equity Tier 1 (CET1) ratio, which means CoCos can be sensitive not only to market conditions but also to regulatory decisions.

Because they combine features of debt and equity, CoCos are considered hybrid instruments: they pay coupons like bonds but can absorb losses through conversion or write-down when the issuer is under stress. A classic example comes from the banking sector, where senior bonds, subordinated bonds, and contingent convertible bonds are common.

For example, a large European investment-grade bank might issue senior bonds at a yield of around 4%, subordinated bonds at 6%, and CoCos at 8%. This tiered structure shows how yields increase as you move further down the capital structure. By moving down, investors can pick up meaningful incremental returns while maintaining exposure to high-quality credit, though they also take on more complexity and risk.

To learn more about Coco bonds and how they fit into your investment portfolio, read our blog “One one ‘CoCo’ full basket”.

Benefits Versus High-Yield Junk Bonds

An important question is why an investor would choose subordinated or hybrid debt from a high-quality issuer rather than investing in more senior, “plain vanilla” junk bonds from lower-rated companies. After all, junk bonds typically offer high yields too.

There are several key benefits:

- Better Underlying Credit Quality: Subordinated or hybrid bonds from strong investment-grade issuers are backed by fundamentally sound businesses. Even though these instruments rank lower in the capital structure, the probability of default is typically lower compared to an unsecured junk bond from a speculative-grade company.

- Stronger Recovery Prospects: In the event of default, subordinated debt from a quality issuer often has better recovery prospects than junk bonds. This is because the overall financial position of a high-grade borrower is stronger, and the loss absorption layers (senior debt, collateral) are usually more robust.

- Diversification of Risk: CoCos and subordinated bonds often behave differently than high-yield bonds during market stress. For example, CoCos are sensitive to regulatory capital requirements, while junk bonds are more exposed to business cycle risks. This provides a diversification benefit for a credit portfolio.

- Regulatory and Structural Support: Many subordinated and hybrid instruments from banks are designed to meet regulatory capital requirements, which can provide an additional buffer against losses. In contrast, unsecured junk bonds often lack such structural protections.

This comparison highlights that while junk bonds and CoCos both offer high yields, CoCo bonds may provide stronger downside protection and diversification benefits for investors focused on long-term credit quality.

Final Considerations

While moving down the capital structure offers the potential for enhanced returns, it’s not without risks. Subordinated bonds can be more volatile, particularly in times of stress, and hybrid instruments like CoCo bonds can carry complex features such as triggers for conversion, coupon deferral, or calls by the issuer. Investors need to fully understand these features before allocating capital, as these instruments can behave unpredictably during market dislocations and are not suitable for every investor.

That said, compared to outright junk bonds, subordinated or contingent convertible bonds from strong issuers offer a compelling way to capture higher yields while maintaining exposure to fundamentally stronger credits. This allows investors to access enhanced income potential without fully stepping into high-yield territory.

For sophisticated investors with the right risk appetite, CoCo bonds can be a valuable tool to boost portfolio income while managing risk, providing attractive returns while still offering links to investment-grade credit quality.

Frequently Asked Questions

Where do CoCos fit in the capital structure?

CoCos are a form of Additional Tier 1 (AT1) capital, sitting just above common equity and below most other debt, including Tier 2 and senior bonds. They’re designed to be the first debt instruments to absorb losses when a bank hits a regulatory trigger point, protecting senior creditors and taxpayers.

How does Additional Tier 1 (AT1) capital differ from Tier 1 capital?

Think of Tier 1 capital as a bank’s main safety cushion, its strongest layer of protection against losses. It includes Common Equity Tier 1 (CET1), made up of ordinary shares, and Additional Tier 1 (AT1), which includes hybrid bonds such as CoCos. AT1 is the riskier part of this cushion but usually offers higher yields.

What is a CoCo bond example?

Imagine a large, reputable bank issuing three instruments: its senior bonds yield 4%, its subordinated bonds yield 6%, and its CoCos yield 8%. The CoCos typically offer the highest yield because they sit lower in the capital structure and carry more risk.

Are CoCo bonds safe?

They carry structural risks, like conversion to equity or loss of value if the bank’s capital falls, but when issued by strong investment-grade banks, they may offer better recovery potential than unsecured junk bonds.

Why do banks issue CoCos?

They help banks maintain capital ratios during stress, satisfying regulatory requirements without issuing new equity immediately.

What risks do Coco bonds carry for investors?

Volatility, coupon suspension, conversion to equity, and regulatory intervention are all key risks.

Are CoCo bonds good for bond portfolio diversification?

Yes. They respond differently to stress than high-yield bonds, making them a useful portfolio diversification tool.

Conclusion and Next Steps

For investors, contingent convertible bonds (CoCos) highlight the balance between yield and risk within the capital structure. They stand apart from traditional subordinated bonds and high-yield junk bonds, offering a unique opportunity for those who understand their complexity.

Ready to see how CoCos or other bond strategies could fit your portfolio? Speak to a Sterling Financial Advisor today.

From the Sterling Team

Marian Ross-Ammar is Vice President, Trading & Investment at Sterling Asset Management. Sterling provides financial advice and instruments in U.S. dollars and other hard currencies to the corporate, individual and institutional investor. Visit our website at www.sterling.com.jm

Feedback: If you wish to have Sterling address your investment questions in upcoming articles, email us at: info@sterlingasset.net.jm