Bonds have long been a dependable way to grow income without taking on excessive risk. For investors in Jamaica and across the Caribbean, they provide not just predictable payments but also protection against market swings and currency depreciation. At their core, bonds are a fixed-income investment. You lend money to an issuer and in exchange you receive interest payments until the bond matures, when your principal is returned.

Key Takeaway

- Bonds generate steady income while supporting long-term capital preservation.

- USD-denominated bonds give Jamaican and Caribbean investors added stability.

- Knowing the difference between bond yield vs interest rate helps avoid paying more for less income.

- Discount vs premium bonds and callable bonds each have trade-offs worth weighing.

- In uncertain markets, bonds remain a proven low-risk investment.

Why Bonds Matter for Income and Securit

Inflation and volatile equity markets have left many investors looking for more reliable income. Bonds answer that call. They deliver coupon payments on a fixed schedule, protect the value of your original investment when held to maturity, and help guard against local currency pressures. For Caribbean investors, holding bonds in US dollars adds another layer of reassurance, offering income in a stable currency.

How Bonds Work: The Basics

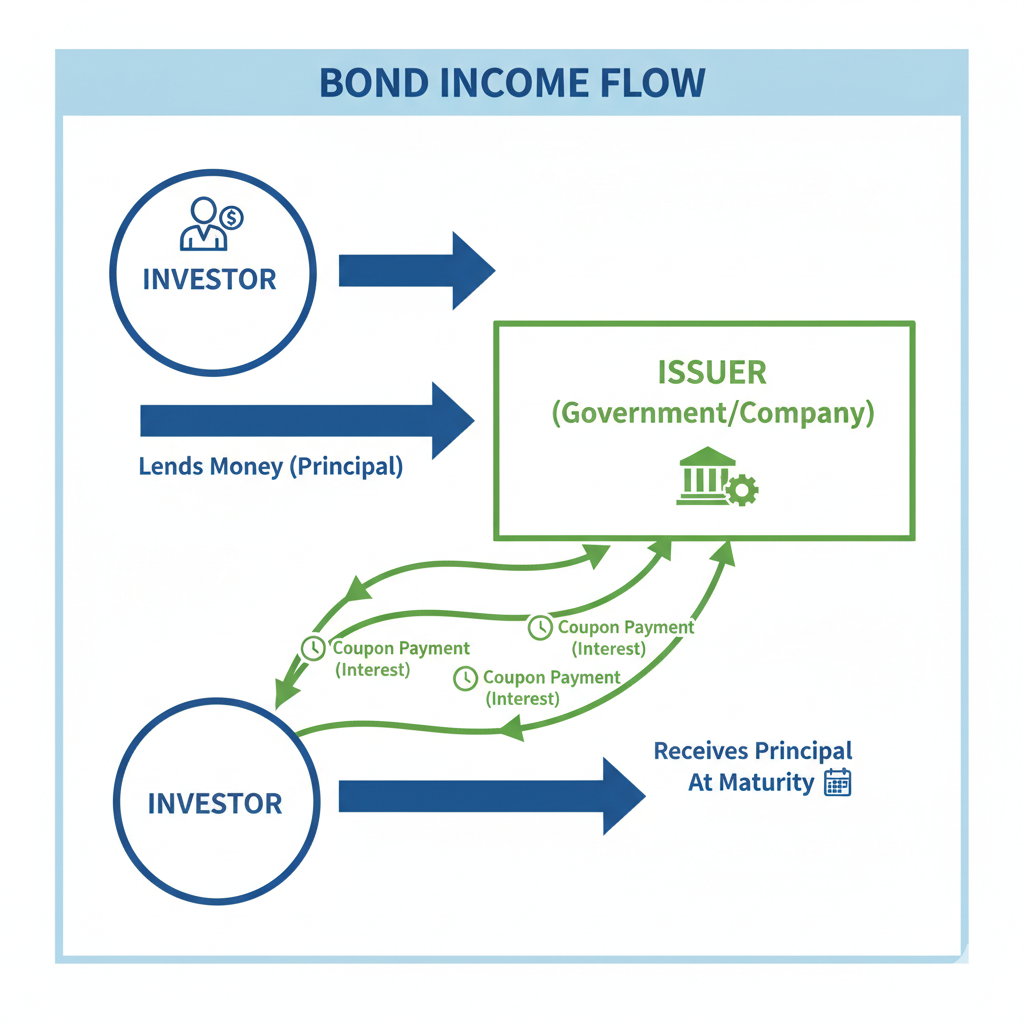

Purchasing a bond is essentially lending money. Governments, companies, or agencies issue bonds to raise capital, and in return they pay you interest and later repay the principal.

For example, buying a $1,000 bond with a 5% coupon gives you $50 per year until maturity. This predictability is what makes bonds a fixed-income investment.

Bond Yield vs Interest Rate

The interest rate (or coupon) is what the issuer promises to pay. Yield reflects what you actually earn once price is factored in.

- At face value, yield equals coupon.

- At a discount, yield rises and boosts income.

- At a premium, yield falls below the coupon.

Understanding bond yield vs interest rate is key to comparing options fairly. It shows whether a bond offers genuine value or if its price reduces the return.

For more detail, see our companion article: The Difference Between a Yield and an Interest Rate.

Discount vs Premium Bonds

Bond prices shift as interest rates change.

- Discount bonds sell for less than face value and usually give higher yields.

- Premium bonds cost more than face value and typically deliver lower yields. Because they are repaid at par, investors may see their effective income reduced over time.

Recognising these differences helps you decide how bonds fit into your broader bonds investment plan. Learn more here: Buying Bonds (Premium vs Discount).

Callable Bonds

A callable bond lets the issuer repay early, often when market rates drop. These bonds often pay higher coupons, but if the issuer redeems them early your income stops and you may face reinvestment risk. For investors seeking consistency, it is important to know exactly what terms apply before investing.

Income Bonds

Unlike standard bonds, income bonds only pay interest if the issuer has enough profit. While they can deliver higher returns, they carry more risk and are best suited to experienced investors with diversified portfolios.

How Bonds Generate Income at Sterling

Sterling Asset Management connects clients with global USD bonds investments designed to provide predictable, hard-currency income. Our team reviews each factor, from bond yield vs interest rate comparisons to callable terms and credit quality, so that your bonds investment is aligned with your personal goals.

For Caribbean investors, USD-denominated bonds also support capital preservation, shielding savings from inflation and currency weakness.

Why Bonds Are a Good Fit Today

With higher rates and ongoing uncertainty, it is the perfect time to revisit the question of how bonds generate income for investors. Bonds deliver something most portfolios need: stability.

They diversify exposure, preserve wealth, and offer reliable income streams. For retirees and risk-conscious investors, they are a tried and tested low-risk investment that balances peace of mind with financial returns.

FAQs

Do bonds pay monthly or yearly income?

Most bonds pay semi-annual coupons, though some pay quarterly or annually.

Which bonds give the highest income?

Discount bonds and callable bonds often deliver higher coupons, but both involve extra risks.

How do bonds work for beginner investors in Jamaica?

They provide a straightforward way to earn USD income while protecting capital. You lend money to an issuer, receive coupons, and get your principal back at maturity.

Are callable bonds good for income investors?

They can be, but you must balance attractive coupons with the risk of early repayment cutting income short.

How safe are bonds compared to stocks?

Bonds are generally safer because they pay fixed income and repay principal at maturity. The level of safety depends on the issuer’s credit strength.

What is the minimum amount needed to invest in bonds with Sterling?

Sterling provides access to global USD bonds with options for both new and experienced investors. Minimums vary by bond type, so it is best to speak with an advisor for details.

Bringing It All Together

Bonds are more than fixed payments. They support capital preservation, provide dependable income, and add balance to your portfolio. Whether you are comparing bond yield vs interest rate, looking at discount vs premium bonds, or considering callable bonds, the right mix strengthens your financial plan.

For practical steps on how to include bonds in your strategy, see: Adding Bonds to Your Portfolio.

From the Sterling Team

At Sterling, our goal is to help investors build strong, secure portfolios that provide consistent returns in hard currency. Whether you are just beginning or preparing for retirement, our advisors are here to match solutions to your needs.

Visit www.sterling.com.jm or email info@sterlingasset.net.jm.