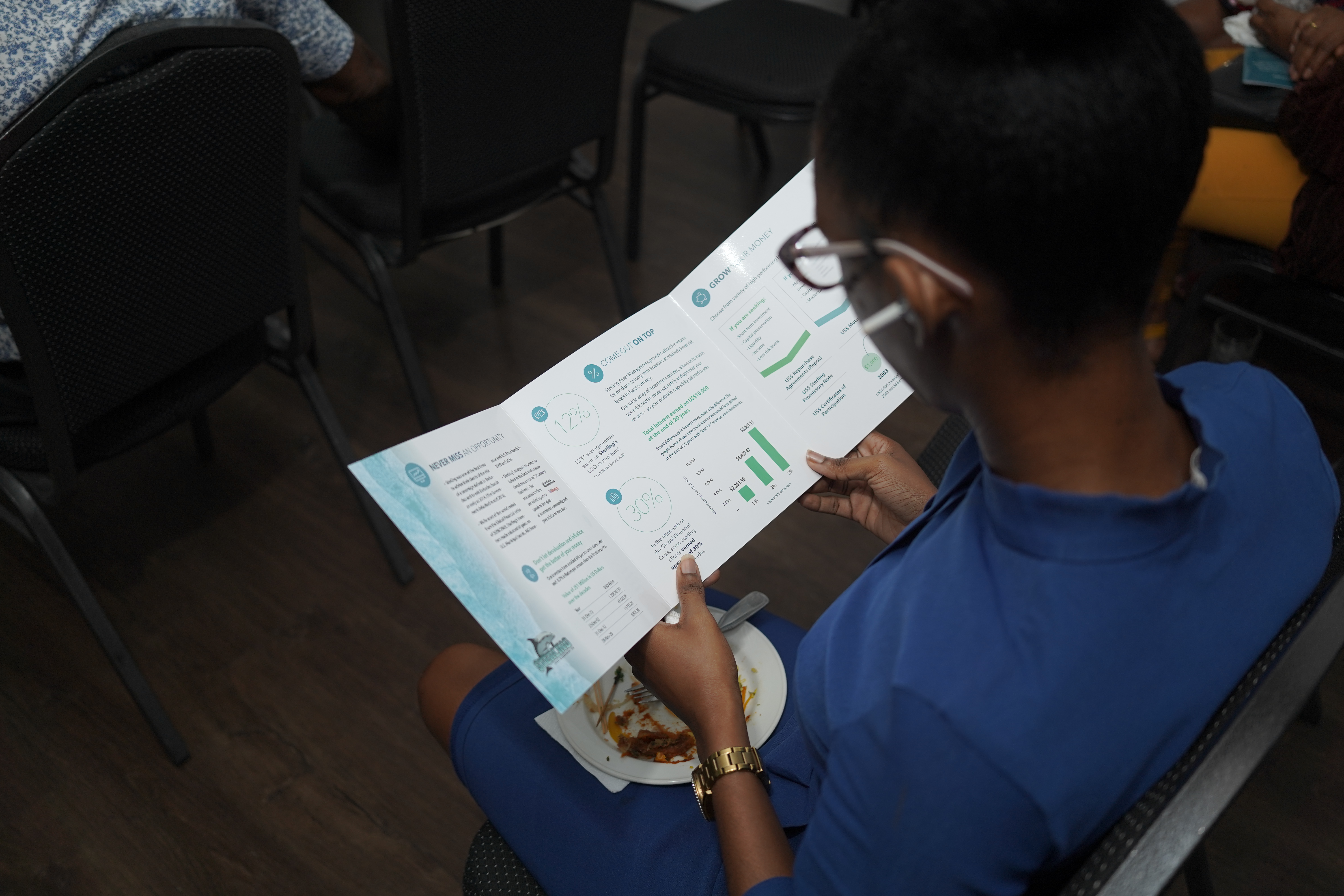

Finding opportunity

Last week my colleague Dwayne shared with readers the importance of financial agility, especially in volatile markets. An investor may wonder if they should change course and if there are truly opportunities out there when market conditions appear to be declining rapidly? While every investor is different, the general answer is yes there are opportunities.