Callable Bonds

Jan 07, 2010

Callable bonds

This week, the Sterling report aims to introduce another common feature of fixed income instruments – call options. By explaining the way a call option works, the implications and the pros and cons, we hope to improve your ability to evaluate your investment options.

Bonds that are structured with call options are referred to as “callable bonds”. A call option gives the issuer of the bond the right (but not the obligation) to redeem the bond at specified dates prior to the maturity date. Essentially, the issuer retires the bonds by returning the principal to the bondholders. A callable bond is governed by a variety of conditions that usually stipulate the dates (referred to as a “call date”) and prices (referred to as a “strike price”) at which the issuer is permitted to redeem the bond.

Implications of Call Options

Call options have quite a few important implications.

Higher coupons and yields

Bonds structured with call options usually attract a higher coupon (and yield) than other “non callable” bonds (i.e. bonds without call options). This is needed to compensate the bondholder for “reinvestment risk”. When you invest in a callable bond you face the risk that your principal may be redeemed and that you may have to reinvest your money at a lower rate. The higher coupon is designed to compensate the bondholder for this risk. In addition, issuers may offer bonds with a strike price in excess of the par value. These factors increase the return that an investor may earn.

You may be asking: With higher interest costs, how does a callable bond benefit the issuing entity? Callable bonds benefit the issuer because they allow them to reduce the cost of their debt should interest rates fall in the future.

Yield to call vs. Yield to maturity

It is very important to understand the technical implications of embedded call options. The most common bond indicator quoted is the yield to maturity. This is the total return that an investor can expect to earn on his capital if he holds the security until maturity. With callable bonds, an additional measure known as the “yield to call” is frequently used to describe the return on the security. This measure estimates the return an investor will earn until the first call date, i.e. it assumes the bond is called on the first call date. The yield to call therefore does not give a comprehensive view of the return on your callable bond; it must be analyzed in conjunction with the “yield to maturity”.

Different Price behaviour

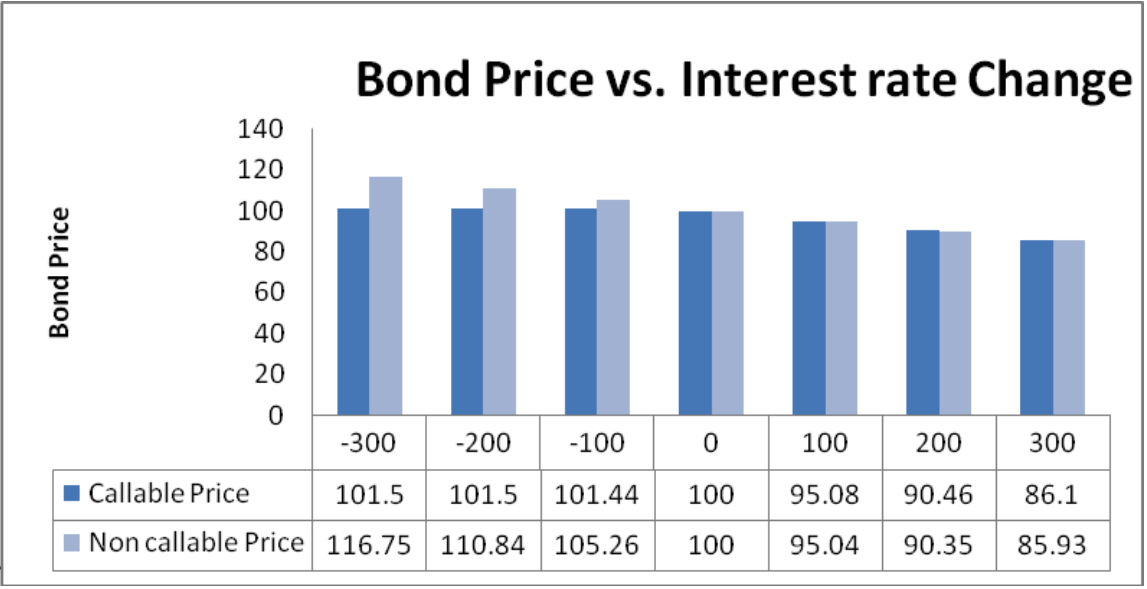

It is also important to note that the market prices for callable bonds behave differently from the prices for non-callable bonds. For non callable plain vanilla bonds, interest rate increases lead to a decline in bond prices and vice versa. These bonds have a fixed life span and the series of interest payments throughout the life of the security is pre-established and can, therefore, be valued with a fair degree of accuracy. As interest rates rise, the value of these payments decrease and the price of the bond also declines. Conversely, callable bonds do not have a fixed tenor, therefore an estimation of the volume and value of the future flows generated from the security is unlikely to be precise. However, as interest rates rise, the issuer is less likely to redeem the bond and the bondholder will continue to receive the existing premium on his /her coupon payments.

The Graph above illustrates that when interest rates are rising, the price of the callable bond declines at a slightly slower pace than that of the non-callable bond. However, the converse is also true; the call option limits the room for price appreciation resulting from declines in interest rates.

Overall, callable bonds reduce the duration risk inherent in the security by effectively shortening the maturity profile of the instrument. As we can see from the graph above, the price of callable bonds is less responsive to changes in interest rates than the non callable security.

A good time to consider a callable bond

Interest rates are at historic lows and can only likely increase in the medium to long term. As such, it is an opportune time to invest in an instrument which provides price protection against the future interest rate increases, and also offers an attractive return on your capital.

A knowledgeable investment advisor will be able to provide more details about the risks and benefits of callable bonds and also recommend one that is right for you.

Marian Ross is a business development officer with Sterling Asset Management Ltd. Sterling provides medium to long term financial advice and instruments in the U.S. and other world market currencies to the corporate, individual and institutional investor.