Key takeaways

- Callable bonds let issuers redeem before maturity at set call dates and prices.

- Investors earn higher coupons in exchange for call and reinvestment risk.

- The upside is capped when rates fall, while downside can soften when rates rise.

Callable bonds

This week, the Sterling report aims to introduce another common feature of fixed income instruments – call options. By explaining the way a call option works, the implications and the pros and cons, we hope to improve your ability to evaluate your investment options.

Bonds that are structured with call options are referred to as “callable bonds”. A call option gives the issuer of the bond the right (but not the obligation) to redeem the bond at specified dates prior to the maturity date. Essentially, the issuer retires the bonds by returning the principal to the bondholders.

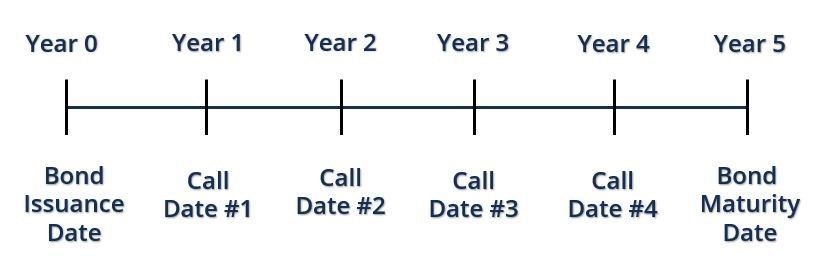

A callable bond is governed by a variety of conditions that usually stipulate the dates (referred to as a “call date”) and prices (referred to as a “strike price”) at which the issuer is permitted to redeem the bond.

In short, callable bonds let issuers repay early; investors earn higher coupons in exchange for call and reinvestment risk. Callable bonds are most commonly issued by governments, municipalities, and corporations that want flexibility to refinance debt if interest rates decline.

Types of callable bonds

American Callable Bonds

American callable bonds may be redeemed by the issuer at any time after the call protection period has expired. This structure provides the issuer with maximum flexibility but creates more uncertainty for investors, as the timing of redemption is less predictable.

European Callable Bonds

European callable bonds, by contrast, may only be redeemed on a single, pre-specified date. While this is more restrictive for the issuer, it gives the investor greater clarity about the life of the bond.

Bermudan Callable Bonds

Bermudan callable bonds sit between these two approaches. They can be redeemed on certain scheduled dates, for example once a year after an initial period, providing some flexibility to the issuer while retaining a degree of predictability for investors.

Make-whole call

Some callable bonds also include what is known as a make-whole call provision. In this case, if the issuer chooses to redeem the bond early, they must pay a premium calculated as the present value of the remaining coupon payments. This structure tends to be more favorable to investors, since it compensates them fairly for income they would otherwise have received.

To learn more about make‑whole call options, review our blog: Call and Make Me Whole

Implications of Call Options

Call options have quite a few important implications.

Higher coupons and yields

Bonds structured with call options usually attract a higher coupon (and yield) than other “non callable” bonds (i.e. bonds without call options). This is needed to compensate the bondholder for “reinvestment risk”. When you invest in a callable bond you face the risk that your principal may be redeemed and that you may have to reinvest your money at a lower rate. The higher coupon is designed to compensate the bondholder for this risk. In addition, issuers may offer bonds with a strike price in excess of the par value. These factors increase the return that an investor may earn.

You may be asking: With higher interest costs, how does a callable bond benefit the issuing entity? Callable bonds benefit the issuer because they allow them to reduce the cost of their debt should interest rates fall in the future. If rates decline, the issuer can call and refinance at a lower coupon, reducing interest expense.

For investors, this potential for early redemption makes it important to compare yield to call with yield to maturity, as each measure reflects a different outcome depending on whether the bond is redeemed or held to its full term. Depending on market conditions, callable bonds may trade at a discount if the likelihood of a call is low, or closer to par if a call is expected.

Yield to call vs. Yield to maturity

It is very important to understand the technical implications of embedded call options. The most common bond indicator quoted is the yield to maturity. This is the total return that an investor can expect to earn on his capital if he holds the security until maturity. With callable bonds, an additional measure known as the “yield to call” is frequently used to describe the return on the security.

This measure estimates the return an investor will earn until the first call date, assuming the bond is called at that time. The yield to call therefore does not give a comprehensive view of the return; it must be analysed alongside the yield to maturity.

Issuers are most likely to call a bond when prevailing interest rates are significantly lower than the bond’s coupon, since this allows them to refinance at a cheaper cost. In practice, always review both measures side by side before investing in callable bonds.

If your bond is called, it’s important to plan what to do with those proceeds. Read our guide on Things to Consider Before Investing Your Call Proceeds

Price behavior of callable bonds vs non‑callable bonds

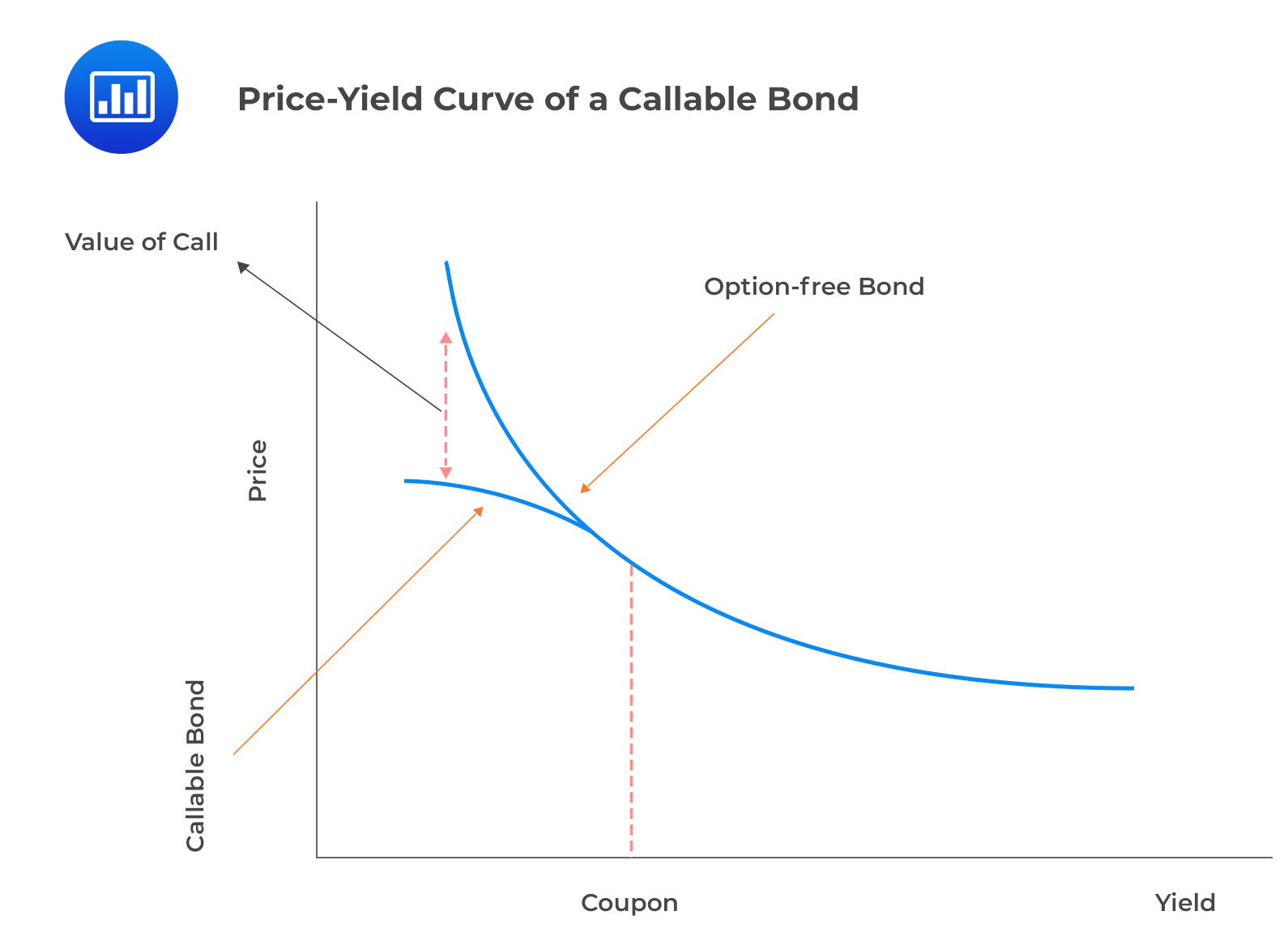

It is also important to note that the market prices for callable bonds behave differently from those of non‑callable bonds. A unique feature of callable bonds is that they can rise less when interest rates decline and fall less when interest rates rise. This creates a flatter, more compressed curve in the bond’s price–yield relationship.

In contrast, non-callable bond (or straight bond) prices typically move in proportion to rate changes, especially if the market believes the bond will remain outstanding.

The graph above illustrates that when interest rates are rising, the price of a callable bond may not decrease as much as a non‑callable bond. However, when rates fall, the callable bond is more likely to be called.

As a result, its price will rise at a slower rate compared to a non‑callable bond, which has no such restriction. When interest rates are falling, the potential for price gains is capped by call risk, while in rising-rate periods the reduced likelihood of a call can help to temper the extent of any price decline.

Overall, callable bonds reduce duration risk by effectively shortening the maturity profile of the financial instrument. The potential for a shortened life from early redemption makes the bond less sensitive to interest rate changes than a non‑callable security.

A good time to consider a callable bond

Interest rates are at historic lows and can only likely increase in the medium to long term. As such, it may be an opportune time to invest in a financial instrument that provides price protection against future rate increases and also offers an attractive return on your capital.

When rates are low or steady, callable bonds can give investors good income and some protection if rates rise, though the chance for gains is smaller if the bond is called. Whether callable bonds are a good investment ultimately depends on your outlook for interest rates and your income needs.

FAQs

What is a callable bond?

A bond that lets the issuer redeem it before maturity on set call dates at a set call price.

Callable VS Non-Callable Bonds — what’s the difference?

Callable bonds can be redeemed early by the issuer, while non-callable bonds (also known as straight bonds) cannot. Compared with other types of bonds, callable bonds generally pay higher coupons than convertibles and puttables, but they carry greater reinvestment and call risk.

Why do issuers use callable bonds?

Issuers use callable bonds to keep flexibility. If interest rates fall, they can pay off their debt early and borrow again at a lower rate, reducing their interest costs.

Why do callable bonds pay higher coupons?

They compensate investors for call and reinvestment risk if the bond is redeemed early.

What are the risks of callable bonds?

The main risks are reinvestment risk, call risk, and limited upside potential when interest rates fall.

Are callable bonds a good investment?

Callable bonds may be a good choice for investors seeking higher income, but they carry call and reinvestment risk, which can limit total returns if the bond is redeemed early.

What is the difference between yield to call and yield to maturity?

Yield to call assumes redemption at the first call date; yield to maturity assumes you hold the bond until it matures.

What is a make‑whole call option?

A call provision where the issuer pays a premium based on discounted future coupons, often more favorable to investors than a standard call.

Making callable bonds work for you

A knowledgeable investment advisor can provide more details about the risks and benefits of callable bonds and recommend one suited to your objectives. Your advisor can also help you weigh yield to call against yield to maturity based on your time horizon and risk profile.

Speak to a financial advisor to discuss whether callable bonds fit your investment portfolio.

From the Sterling Team

Marian Ross is a business development officer with Sterling Asset Management Ltd. Sterling provides medium to long term financial advice and instruments in the U.S. and other world market currencies to the corporate, individual and institutional investor.

Feedback: If you wish to have Sterling address your investment questions in upcoming articles, e-mail us at: info@sterlingasset.net.jm